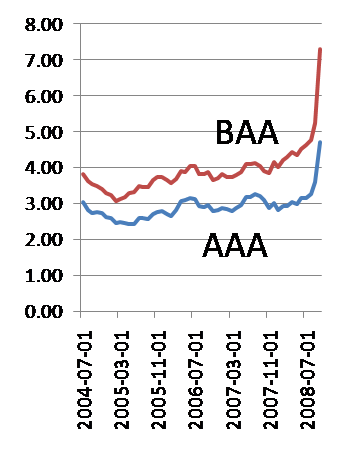

Credit spreads currently present a new "conundrum", the word Greenspan once used for an interest rate poser in another context.

What may be driving rates, rather than volumes, is the ongoing assessment of the worst-case economic probabilities.

To me, these markets look like they are pricing in what we might call "event risk". Credit risk doesn't seem to be trading off fundamentals, like historical default probabilities for highly rated debt, even peak probabilities for an economic downturn. Instead, these prices appear to be discounting the likelihood of financial system collapse leading to an economic collapse OR a business failure in the real economy (like GM?) that may induce cascades or feedback into the financial system in ways not easily observed ex ante.

The additional premium for that risk may be wrongly interpreted as a "credit crunch" - even if a persistent and prevailing uncertainty may end up causing a genuine one, paradoxically.

It may seem like a trivial point, but it helps in getting a tight analytical framework. We aren't fighting an "ordinary" credit crunch. It looks like we are still principally fighting the risks of the bottom falling out, right? Of course, the truth is some complex combination of the two.

From FT Alphaville, pricing "Armageddon":

European credit spreads were lurching back towards “Armageddon levels” on Wednesday, flirting with their all time highs as speculation mounted over a bail-out for US carmakers. The Markit iTraxx Europe index of investment grade corporate debt widened 12.9 basis points to 175bp, up from a Tuesday closing price of 162bp. The iTraxx Crossover widened by 27.8bp to 899.46, teetering on the brink of the symbolically important 900bp mark last crossed in the fallout after Lehman Brothers collapsed.

No comments:

Post a Comment