Part One

WE ALREADY HAD A 'SUBPRIME' MORTGAGE CRISIS, THIS IS THE SECOND IN A ROW

In his recent op-ed, Paul Krugman wonders aloud about our "Ponzi era", about how we all could have not noticed, basically, about financial services in general. He concludes, in essence, that we lived an era of post hoc, ergo propter hoc, regarding those looking the part in money management. {But read the comments section for the good stuff}

Many others, including the ever-readable Martin Wolf, have looked in detail at how "we" missed it, how the latest junk-credits from Wall Street went undetected until it was too late.

Greenspan himself has indicated that he relied on the collective wisdom of market participants, ending up shocked that they failed to secure the (long-term?) interests of shareholders.

For my own part, I initially underestimated what would become the full scope of the problem. I think it is because I didn't imagine that Green Tree Financial had left the collective conscience.

REMEMBER GREEN TREE FINANCIAL?

Well apparently, not too many people do. I remember it vividly, however.

Did the quantitative people in the departments at the ratings agencies (Moody's, S&P) have more than a degree? Did someone from the "real" credit area take an elevator down to look over the shoulder of their proverbial CDO Queen? Was there a risk-policy committee? God knows, the implication of Green Tree made it to the radar screen of leading economists (and, as best I recall, Greenspan's purview. Update: yes, see here).

There should be more hearings, right?

Anyway, here is the story of Green Tree Financial and the manufactured housing bust.

I've pulled some quotes, that make it rather plain just how much it looks like the very same sub-prime crisis that eventually grew to $700-1,800 billion.

The question becomes, how did we have two sub-prime crises in a row, in rapid succession, even?

A Boom Built Upon Sand, Gone BustFrom 1991 to 1998, annual sales of manufactured homes more than doubled, to 374,000 from 174,000.

One company, one man and one accounting rule drove that growth.

The rule, a rarely used accounting convention called ''gain on sale,'' encouraged Green Tree to make as many loans as possible and allowed it to report more than $2 billion in profits that never existed.In their rush to lend, Green Tree and its rivals made loans to borrowers who had little chance of paying them back. Tens of thousands of those people have already defaulted and have been evicted. Conseco alone has repossessed 25,000 homes so far this year, after a record 28,466 in 2000. By the time the industry's hangover ends later this decade, hundreds of thousands more low-income borrowers will lose their homes. They will wind up with huge debts and ruined credit because their homes are worth far less than what they owe.

Securitization provided Green Tree with ready access to capital from the bond buyers, and that enabled it to finance as many loans as it wanted. At the same time, gain-on-sale accounting allowed Green Tree to record income from every loan that it made.

On April 28, 2000, with the company's shares at $5.63, Mr. Hilbert quit. He received a $72 million severance package, including the right to use Conseco's private jet up to 20 times a year. All told, Mr. Hilbert's pay from 1993 to 2000 was $530 million.

Mr. Coss did not do quite as well. His pay, tied to Green Tree's reported profits, totaled about $200 million from 1993 to 1998, including a $30 million severance package.

More references:

April, 19998:

April, 2000:

[This one reads like a bad omen for the Bank America and Merrill "merger", yes?]

December, 2002:

Friday, December 19, 2008

It Was Not an 'Act of God', Part II

Posted by

Amicus

at

8:57 PM

0

comments

![]()

Labels: 2008 Financial Crisis, Fannie Mae

The Panic In Pictures - Merrill Uplift Edition

It was a good time to be in "fixed" income in mortgages at Merrill:

A peek at what may show up on the 'expenses deed' of a CDO:

Merrill Lynch collected about $5 million in fees for concocting Costa Bella, which included mortgages originated by First Franklin.

Posted by

Amicus

at

8:28 PM

0

comments

![]()

Labels: 2008 Financial Crisis

Thursday, December 18, 2008

For the record ...

John Steel Gordon with the long view on Ponzi schemes.

Still, no one has the data on the longest running - biggest means nothing. (In fact, no one knows how long Madoff was running his, exactly. It may have been a regular fund for a while.)

Posted by

Amicus

at

2:43 AM

0

comments

![]()

Labels: Serious Fraud

Wednesday, December 17, 2008

A mysterious demand for housing

By postulating that there is a demand for housing, in an economy rapidly shedding jobs, tightening credit requirements, and casting a huge number of citizens into the 'no-credit-at-all' category (bankruptcy/foreclosure), Hubbard and Mayer conclude:

A reduction of mortgage interest rates to 4.5% (or, given yesterday's Fed action, to a lower level) is superior to other proposals that focus only on stopping foreclosures, or on reforming the bankruptcy code to keep people in their homes. Stopping foreclosures, however meritorious, may not limit the dangerous decline in house prices as much as proponents claim. It could work the other way. Stripping down mortgage balances in bankruptcy would likely raise future mortgage interest rates and lower the availability of mortgages, reducing house prices.

Loan modifications are a reduction in interest paid, right? They also directly and quickly affect the structural challenges. An interest-rate only mechanism could extend the 'debt-depression' for years.

There is a

Given the problem is so serious, why 'bet the farm' that an artificially reduced rate will bring the desired equilibrium? Given all the hope-for-the-best approaches that have already failed, across a range of problems, wouldn't the direct approach, modifying some loans, actually be more robust?

The Businessweek study:

That's especially true in California. In the second quarter of 2008, seven in 10 existing-home sales in San Joaquin and Merced counties were of properties that had gone through foreclosure in the previous 12 months, according to DataQuick, a La Jolla (Calif.) real estate information company. In Sacramento County, six in 10 sales involved foreclosures.

It's no wonder that prices in these markets are tumbling: Distressed sales have a way of dragging prices down for entire communities. Aaron Smith, senior economist at Moody's Economy.com, says markets in which foreclosed homes dominate listings suffer from a kind of "negative feedback loop."

Posted by

Amicus

at

10:39 AM

0

comments

![]()

Labels: Fixed Capital Investment, Housing

More Ratings Agency Voodoo?

So, Moody's has a double barrel this week, downgrading both Goldman and Morgan Stanley to A2 from A1.

Goldman has $110 billion in excess liquidity on a balance sheet of $885 billion. They've cut compensation by $10 billion (in half).

Goldman's competitive position has never seemed stronger, with the competition boxed-in, and the idea that "investment banking" (or even trading) is finished for good is pretty radical.

Accordingly, it looks like the ratings agencies are practicing a bad voodoo.

Posted by

Amicus

at

9:27 AM

0

comments

![]()

Tuesday, December 16, 2008

'Everything I had, I gave to Madoff'

Well, the stories are coming out.

Q: If someone with high liquid net worth comes to you and says, "here is all the money I have in the world", what do you do? Do you turn them away, in whole or in part?

Unless I intended to provide them with a significant diversification, I would, right? You?

Posted by

Amicus

at

3:22 PM

0

comments

![]()

Labels: Serious Fraud

Fed hits rock bottom

POLICY AT POINT OF MAXIMUM DEPARTURE - FLAPS AT FULL

0.0% to 0.25% as a target for funds, discount rate down to 0.5% and "excess" reserves at 0.25%

There is a case that zero is not a good rate of interest.

Dividend and credit rates are overwhelmingly attractive now.

[Remember the summertime and the ideologues who were issuing statements that the Fed needed to fight inflation? How ridiculous was that, in hindsight...]

THE RETURN OF THE CARRY TRADE - WE'RE ALL ON THE DOLLAR NOW?

The cost of hedging yen is nearly zero. The Euro is probably not far behind.

That means there is a huge reservoir of liquidity available for sensible risk, credit or otherwise.

Posted by

Amicus

at

2:24 PM

0

comments

![]()

Labels: 2008 Financial Crisis

Housing Set to Overshoot

New building is set to go to zero, apparently. Permits for new construction clocked a measly 616K, s.a.r., which is nearly 50% below a year ago and an all-time low.

The impact of this on employment is material.

On both scores, housing prices look set to overshoot to the downside, without a plan to smooth over this adjustment from the "boom" period.

Construction job losses - across all segments - account for some 30% of all job losses so far.

Posted by

Amicus

at

10:27 AM

0

comments

![]()

Labels: Fixed Capital Investment, Housing

Bank Health - Goldman's Temperature

Goldman took its balance sheet down a whopping $200 billion in the quarter, to $885B.

Still, if Goldman was a key counterparty for the new Treasury/Fed "program" for AIG, it didn't show up in so-called "Level III" assets, which were down just $2B.

Posted by

Amicus

at

9:42 AM

0

comments

![]()

Monday, December 15, 2008

The Good Life

Another fraud, who has the special joy of being ... out-done this week (and, therefore, out of sight?). Mr. Dreier.

As one bank-examiner noted long ago during the Milken junk-bond fiasco, "look for the bankers with the Italian shoes."

He has a triplex apartment on the East Side of Manhattan, along with a house near the beach in Southampton, N.Y., and a 120-foot yacht. The walls of his Park Avenue office drip with expensive modern art, and he kept three personal assistants busy.

He peddled false notes to eager hedge fund investors, among others, so says the NYT, to the tune of $113 million.

These things are fascinating, because they are so far beyond the realm of my constitution to even conceive of such a scheme. It's like looking at a different world - and I don't mean the yacht, etc.

Posted by

Amicus

at

7:24 PM

3

comments

![]()

Labels: Serious Fraud

Hyperbole Reins

Former SEC chair Breeden calls Madoff "gang" activity "speechless cruelty".

You'd think the guy committed genocide...

I can't help but think that the vehement furor over the SEC is a ploy to find ... deep pockets to pay back a bunch of silly investors.

Posted by

Amicus

at

7:08 PM

0

comments

![]()

Labels: Madoff, Serious Fraud

Cramer: Shorts Took Down Bank Stocks

Based on data from the NYSE, Cramer said today that bank stocks had been the subject of a classic "bear raid", focusing his criticism on the repeal of the up-tick rule and ... the SEC (?).

No word on naked shorts. The figures appear to reflect just intra-day trading volume.

Posted by

Amicus

at

7:06 PM

0

comments

![]()

Labels: 2008 Financial Crisis

Quote for the Day

Well, the day hasn't begun, but here it is:

What card issuers have really cared about for a very long time is _raising_ credit limits to boost throughput so they could pinch off more dough from the financial system. Yes, the _financial system_, which was the real customer for card issuers. We card holders are just hazel stumps to be coppiced and sold as wands for the magicians of finance.

-Commentor, Naked Capitalist

There are a lot of people stressed because the notes from the card companies make it sound like they did something wrong or could have done something better.

And, sadly, there are prominent, TV-enabled financial planners who encourage that view, if only because they get a lot of calls from people who really have not managed their credit well.

Anyway, ... I'd like to know who holds the residuals in the Card Master Trusts. I think the card companies take a hit in some of these securitizations - it's not just a pass off.

Posted by

Amicus

at

3:02 AM

0

comments

![]()

Labels: 2008 Financial Crisis, Consumer Credit, Credit Cards

Charity Redux

I am supposed to feel particularly sad for charity Boards who put large sums of money to work in loosely regulated "strategies", like Madoff?

Isn't there something inherently repugnant about people, very wealthy people, clamoring - clamoring - to "get in" on a money-management strategy that could be replicated by a computer?

How much more protection do you get from regulated entities, one wonders.. Do rules to follow, public filings, etc., show a meaningful reduction in fraud cases or size of fraud cases?

Posted by

Amicus

at

2:09 AM

0

comments

![]()

Labels: Madoff, Serious Fraud

The Panic In Pictures

"Level III" Crisis

Fed goes to DEFCON 5, as ... a big firm disappears with few knowing exactly why, other than that there was no will to save it.

(chart via Alea):

Posted by

Amicus

at

1:59 AM

0

comments

![]()

Labels: 2008 Financial Crisis

It Was Not an 'Act of God', Part I

All these are false or incomplete:

- - "One is a failure to recognize the unavoidable uncertainty surrounding estimates deep in the tail of distributions based on limited data."

- -Default likelihoods and correlations were "misestimated", leading to a gross 'mispricing of credit risk'.

- -"Another failure is a lack of structural imagination in assessing the likely consequences of contingent events such as a general fall in housing prices."

- - Housing prices were thought to only go up (even in the United States), by any or all of brokers, speculators, buyers, lenders, and regulators.

Also up for batting practice, "we have just seen a black swan", although that one might be a little more complicated.

Franklin Raines, Chairman of Fannie Mae, 1999-2004:Given that there has been relevant experience and data, among the possible implications:

"The company had significant experience during the 1980s and early 1990s with the impact of falling housing prices on the value of mortgages. In the 1980s, the company experienced significant credit losses as a result of the economic meltdown in the oil patch areas of the Southwest. In the early 1990s, the overheated housing markets in California and New England also caused significant losses.

The company also studied the different credit performance characteristics of mortgages with certain features, such as adjustable rates or negative amortization; mortgages with certain underwriting approaches, such as no documentation of assets or income; and mortgages with certain borrower types, such as those with marginal credit or housing speculators. These features create greater credit risk. Furthermore, the layering of more than one of these characteristics on an individual loan greatly magnifies the risk. In many cases, there is no precedent to rely on to calculate the performance of such risk layering."

- Institutional memory is important.

- It is often wise to analogize risk from similar events, rather than discount it.

- Imagination happens to the prepared mind.

Posted by

Amicus

at

1:01 AM

0

comments

![]()

Labels: Fannie Mae

Sunday, December 14, 2008

This Week In Markets History

NEGATIVE NOMINAL RATES ON US T-BILLS

The most notable historical market for this past week was that t-bill auction brought negative yields.

I'd bet that is the second time in U.S. history that there has been a negative nominal yield.

Last week's very small backwardation in the gold market got explained as sticky lease rates.

Posted by

Amicus

at

1:15 PM

0

comments

![]()

Labels: 2008 Financial Crisis, Markets History

Friday, December 12, 2008

Quote for The Day

The latest CDS salvo had me go read Arnold Kling's testimony from earlier this week (previously, I just went on what I heard, what was spoken for the committee).

Rather than more on CDS today, here is some more confirming evidence that I, a complete outsider, have the right read on key issues at the GSEs:

When I was at Freddie Mac, there was hardly any gap between the suits and the geeks. The Foster-Van Order model of mortgage default was ingrained in the corporate culture. The CEO, CFO, and other key executives understood this model and its implication that mortgage defaults would be much higher for mortgages with low down payments. Moreover, the suits bought into the idea of using a stress test to set capital requirements. Using a stress test methodology, in which mortgages are evaluated according to how well they would survive a downturn in house prices, the capital required to back mortgages with low down payments is prohibitively high.

When a new CEO came to Freddie Mac in 2003 (several years after I had left), a gap apparently opened up between the suits and the geeks. Warnings issued by the Chief Risk Officer and others about low down payment mortgages were ignored by the CEO.

An organizational failure requires an organizational re-design. It doesn't require a ... a whole lot of hand wringing about everything else.

Posted by

Amicus

at

2:45 PM

0

comments

![]()

Labels: Fannie Mae

Invincible Wall Street, Part II

THERE IS NO BOOKEND FOR THIS TALE, JUST NEW CHAPTERS

- Citibank will pay $7 billion to settle the massive auction-rate securities debacle.

- Fidelitys' crew will settle Wall Street's version of pay-to-play (or plug-'n-play or whatever).

- Last, a fraud scheme so vast that the SEC called it "epic" and Ponzi himself would have either blushed or have had his proudest moment to date. Made possible by complete faith in a little audit group in the middle of nowhere and belied by returns so statistically improbable that Mendel would have grinned.

Madoff’s auditor, Friehling & Horowitz, operated from a 13-by-18-foot office in Rockland County, New York. Vos had an investigator stake out the office [!!! I missed that in due-diligence class]. A call to the New City, New York, office of Friehling & Horowitz after business hours wasn’t returned. (Bloomberg)

Update: CNBC is asking about fraudulent conveyance. I doubt there is such a thing for a fraud itself, right? That's like asking, "Was the fraud conducted fairly?" Who knows, though. It's just crazy enough to be possible...

Update2: split-strike is a fancy, modified buy-write strategy. They promise "daily liquidity".

Update3: Oh, what a list of investors. Every no-name auditor in the industry can expect the phone to be ringing off the hook in the next week.

Update4: Askia says that OEX options market couldn't handle $13 billion ... is that true? It does appear to be. Today's open interest of 188188 appears to suggest a size of just under $8 billion, far in excess of whatever the daily volume would be...

Posted by

Amicus

at

7:35 AM

0

comments

![]()

Labels: Invincible Wall Street, Madoff, Serious Fraud

Thursday, December 11, 2008

CDS - To Be or Not To Be

John Dizard throws in the towel on credit default swaps (CDS). Felix Salmon is not ready to yet. Arnold Kling sees a vindication of a negative (prosecutorial) view.

Here's 2-cents. (This is a long post, but not complex):

Dizard weighs in on three points, "capital raising", "price discovery", and "risk mangement tool":

1. Capital Raising

The 'response' to Dizard's points is in three parts, complicated by the fact that CDS technology has been used in a variety of ways, so broad-brush is no good.

1(a) Balance-sheet management, credit intermediation, structured credits

'Capital raising' may mean the use of CDS in BISTRO-like products and synthetic products that transferred risk and may or may not have freed up risk-capital.

To the best I understand it, the writers of protection in this "structured market" are not the ones who are putting up collateral, now. The buyers put in upfront collateral, as best I know (and what I know about that is very limited).

There may have been additional trading of CDS outside of these structured products, yet related to them, but that is analytically separate - this is just about the products themselves.

It's not at all clear that the goal of credit inter mediation and build-to-suit credit is not worthy. They seem like fairly natural innovations, a step in the conceptual the evolution of risk-sharing and risk-management technologies. Before rejecting an innovation, I'd like to be certain that the risks were either practically or theoretically unmanageable. If there is evidence one way or the other in the current carnage, it needs to be sorted out thoroughly, not summarily.

1(b) Sharing a 'AAA' credit rating via CDS - a "naked" loan portfolio

If he means 'capital raising' to refer to something else, like AIG's (naked?) "regulatory capital CDS" contracts, then that is a different and interesting point. Should the financial strength behind a promise to pay be "tied up" in increasing (decreasing) amounts of capital, as dictated by an illiquid market? If a firm's exposure were just a loan gone bad, there would be no mark-to-market capital requirement. In that case, only a credit event would cause capital "to be posted", "violently" and all 'at once'. Is 'the system' more or less stable for having a seemless capital requirement all along the way, based on market-based assessments of the likelihood of loss?

To me, part of the answer to that lies in whether the CDS market is exaggerating moves in the cash market. So far, it doesn't look like it is. The two appear to be equally bad in tandem. Also, the illiquid, non-traded cash market does move in discreet intervals to require "collateral". As business conditions worsen, lenders' loan covenants get violated. You do not have to wait for "bankruptcy" for significant credit events (compare also ratings downgrades/upgrades). So, in a sense, there has always been a bit of mark-to-market of outstanding credit risk, in the form of demanding "collateral" or proof of ability to pay. The capital impact of credit loans gone bad also occurs explicitly in the loan-loss reserve. If a bank has bad loans, it would be required to estimate the likelihood of those loans being repaid. It takes a non-cash hit to capital, to the extent that the outlook worsens. Is that outlook better estimated by company managements than by CDS market prices?

Do market prices move ahead and faster than "business conditions"? Probably. Does that mean CDS are defunct? That's unclear. You'd have to posit that CDS market prices overshoot and have a (negative) business conditions feedback, more than cash bond/note prices do, right?

Is it as bad as Jesse Eissinger reports, with Bill Demchak agreed (see very end of article), that we have 24- year olds determining the price of things, introducing ridiculous levels of balance-sheet volatility? Maybe, maybe not. I'm not convinced yet which state of affairs is better/worse: illiquid unknowns (opaquely fragile balance sheets) or illiquid knowns (transparently fragile balance sheets - "frozen" in Dizard's terminology).

Last, in a broader view, you can argue that the capital requirements related to the credit risk inherent in a long CDS are the same or less than a loan. If I don't miss my guess, these credit exposures probably graph about the same, over time, as does a vanilla interest rate swap. The fact that the market for CDS might suddenly become illiquid means that VAR is not the only measure, but that notional limits are still a good idea, too.

1(c) Short-term trading of a "view" on credit

If capital raising means just the collateral posted by hedge-funds and dealers swapping views on the direction of this or that credit, then consider this: those risk-transfers are a zero-sum game. If collateral is not also a zero-sum game, then perhaps that needs to be explored, as Felix says. Also, if this is truly short-term trading, then one suspects that these trades unwind/terminate, even at abusive, illiquid prices, rather than being the cause of a sustained, significant, non-economic build-up in collateral.

2. Price Discovery

Dizard says:But CDS are derivative instruments, whose price is "discovered" these days as a function of equity volatility, since buying equity puts is one way to dynamically hedge the illiquid legacy books.

The second part first. This seems to be a variation of the age-old theme that derivatives increase the volatility of the spot/underlying markets. In this case, the author suggests more than that, that there is also a destructive feedback loop, an inherent instability created.

So CDS dealer sales of Citigroup equity through derivatives means higher equity volatility, then higher CDS spreads, leading to more margin calls, leading to more sales of bank stocks . . . This has become a system-wide tail-swallowing exercise in lunacy

First, I may be completely wrong, but I don't think you dynamically hedge (long) CDS using equity puts, in the normal sense of a dynamic, parametric hedge. Buying a put on the equity is a (costly) and sufficient hedge. As the probability of default goes to one, the put value goes up. You are covered. If someone is buying and selling partial hedges as part of an overall strategy, that seems to require another name.

The market maker who bought/sold the equity put might need to delta-hedge in the equity market. To the extent that they are using a market-maker exception to short naked, that's a potential problem. To the extent that non-market makers are restricted to legal shorts, it's not an obvious problem.

Apart from an interesting and important consideration, the sum of this problem seems to be that "price discovery" at or around high default likelihood is problematic. D'oh! The notion that equity volatility is high near times of default is ... not particularly alarming, either. It doesn't have to be high default likelihood, either. It could just be conditions in which no one wants to bear the risk of credit or too few the financing/capacity to take advantage of the price-opportunities created by peak risk-aversion or market illiquidity.

3. Risk Management Tool

Dizard notes:A credit default swap is a very different creature than the traded equity of a "reference entity". CDS cover only one on-off risk, that is, default on reference obligations. So in the airless world of ideal models, CDS values are better considered as binomial probability distributions, rather than as the continuous probability distributions that are closer approximations of equity values.

One could also conjecture that what we are seeing is a dual-pricing regime for CDS, not a bi-modal distribution. One type of pricing for high probability risk of default, when "replication protection" is paramount (for hedging), and another for moderate to low default risk, when replication/no-arbitrage is less important.

Were this a wild ride, you'd expect the CDS spreads to be really, really wide compared to the cash bond spreads, right? At least I would, as all the "weird" theoretical assumptions got violated and knocked risk-models around, etc. Well, so far as I can tell, the CDS are trading at or near the cash bond prices (sometimes even inside the cash spreads).

The reg-cap arbitrage problem at AIG, in my view, could be solved with notional limits, at a minimum, rather than relying on VaR, or sophisticated peak credit-risk calculations. This reflects the fact that a seller of protection (long the credit risk) could end up with a de facto loan. You need capital to cover that "worst case" scenario. Of course, the caliber of the top leadership at AIG at the time appears to be such that that was unknowable...

I confess I do not understand this paragraph, so I cannot comment, although I feel I should be able to, eventually. First pass, it looks like this is a way of estimating some of the parameters of the pricing models in use, and I don't understand its applicability:When implied probability of default, and equity volatility, are relatively low, you can do some seemingly plausible regression analyses to fit the series. But at high levels of default risk and equity volatility, if you hedge the one with the other you get frantic, self-defeating activity.

The point about whether an on-off contract is the best way to trade continuous views about credit spreads is one worth thinking through. Why doesn't the market just trade put/call options, with various strikes, on a variety of credit spreads, for instance? What's the particular allure of the CDS construct?

update:

For those like Arnold Kling looking for a fuller theoretical understanding of CDS, here is Hull & White, available online (not to difficult for those who already have an understanding of options pricing theory):

VALUING CREDIT DEFAULT SWAPS I: NO COUNTERPARTY DEFAULT RISK (link: http://tinyurl.com/3dkufk)

VALUING CREDIT DEFAULT SWAPS II: MODELING DEFAULT CORRELATIONS (link: http://tinyurl.com/57y45p)

Here is the math for backing implied default probabilities for simple contracts.

Posted by

Amicus

at

7:44 PM

0

comments

![]()

Labels: Credit Default Swaps

Quote for the Day

No regulation or law forced banks or the GSEs to acquire loans that were so risky they imperiled the safety and soundness of the institutions. The acquisition of such loans was a business judgment made by management and the boards of directors.

- Franklin Raines, former CEO FannieMae, yesterday's testimony

Raines testimony is fascinating. His grasp of the issues seems to far exceed those of his peers at the table.

More to say later on (I'm reviewing data, sorting out Christmas presents, and much else besides!).

Posted by

Amicus

at

11:38 AM

0

comments

![]()

Labels: Fannie Mae, Franklin Raines

Tuesday, December 9, 2008

Pinto: 8 Million Defaults

Overall cumulative default rates (note the sea-change starting with the 2004 vintage):

In the bleakest testimony yet heard, Edward Pinto, former Chief Credit Officer of FannieMae, suggests that the magnitude of the problem, on his figures, is larger than non-Roubini estimates.

Mitigation must be forthcoming ... we've lost a lot of time already.

It's not just loan modifications, at the margin.

It's a restructuring of all or most mortgage debt, quite possibly, to allow for price falls without the market becoming seriously illiquid.

It's also a change in the legal relationships among lender, borrower, servicers, brokers, and investors, in whatever type of products, products that may also get new transparency requirements, at a minimum.

Posted by

Amicus

at

3:31 PM

0

comments

![]()

Fannie Freddie - First Pass

It was demand pull, not supply push.

The creation of slik purses out of sow's ears had created a credit 'mania' on Wall Street, an insatiable demand for 'product', so much so that large brokerage houses felt the need to have their own, captive sub-prime origination units.

There were other factors, but this, more than the others, is explanatory. It explains almost all the pressures created by the demand for volume.

If anything, I'd be looking for evidence that HUD goals raised in the 2005 period and onward, like so much else, followed or abetted the mania, not that they were the cause of it.

Today's hearing details here.

Posted by

Amicus

at

2:57 PM

0

comments

![]()

Labels: Fannie Mae

Quote for the Day 2

Arnold Kling, who doesn't believe in securitization does not believe securitization is necessary:

it turns out that when a high-risk loan has been laundered by Wall Street, it can come back into the banking system in the form of a AAA-rated security tranche.

Posted by

Amicus

at

2:44 PM

0

comments

![]()

Labels: Fannie Mae

Quote for the Day

"Reality exceeded my imagination." - Daniel Mudd, 2003-2008, FannieMae CEO

***

"For two years, Mr. Mudd operated without a permanent chief risk officer to guard against unhealthy hazards." - New York Times, Oct 5, 2008

Posted by

Amicus

at

1:30 PM

0

comments

![]()

Labels: Fannie Mae

How Does Wall Street Trade "Recovery Rates"?

Over at Alphaville, Sam Jones writes:

A rising default rate is one thing. A rising default rate with a falling recovery rate is quite another.This raises the question of whether Wall Streeters put yet another gun to their own head.

The research, to the extent I know it - not even close to state-of-the-art any longer, is that there is a very significant part of recovery rates that are "systemic" and that they are, in fact, quite pro-cyclical.

So, yes, in a downturn, defaults and lower recovery rates aren't oddball.

Now, has Moody's published their model, so that we can see just how they are doing with this? S&P? Fitch?

Make you a bet: they will stop rating paper before they agree to share their model with the inquiring public, who depend so obviously on the deft execution of their trade.

Posted by

Amicus

at

10:00 AM

0

comments

![]()

Thain and the Gravy Train

BAC share prices has lagged JPM since its "Merrill weekend"...

BAC share prices has lagged JPM since its "Merrill weekend"...

The Merrill Board, who haven't missed a full dividend payment throughout the entire Merrill saga, are wimps for not giving Thain his due. He should have gotten "Grasso money", afterall. He got BAC to overpay by maybe $15/shr (if not more). If Thain recovered 2.5% of that in compensation, it would be $600 million.

The Merrill Board should have paid him, just to send a reinforcing message to Lewis how things are done downtown, right?

Meanwhile, the real question is how much CEO Lewis is going to get this year (and next), eh? Have a look at how he's arguably trashed his shareholders, in the chart above, by bending too far to scoop up toxins... while keeping an eye on how much the top-heavy riches of Merrill's magically endless sugar plums will come his way?

Someone (Nassim Taleb?) forgot to tell him the gold is cursed, maybe...

Posted by

Amicus

at

9:28 AM

0

comments

![]()

Monday, December 8, 2008

"No Soup For You!!!"

Posted by

Amicus

at

11:32 AM

0

comments

![]()

Excelsior Risk Management

Paul K has the video of Nassum Taleb on Charlie Rose.

From the talk, I'd guess that Taleb over-estimates the momentum for change.

It still amazes me just how much risk management topics are popularized or topical. I never pegged this field as one with "legs", as they say. That's neither here nor there, though.

Just as a matter of fact, the notion that financial market distributions are non-Gaussian has been around since the 1960s. It's not clear how Nassum intends to actually manage/run a firm's risk, in the case of non-finite variances ... (perhaps I should read the book? D'oh!).

VaR, even at 2-sigmas, was never meant to be a catch-all risk measure, was it? Accordingly, it just sounds like firms have another round of risk measurement to go through and that folks, like RiskMetrics, have been over-priced for a long time now (and out of the public view - who called them to Washington to testify, eh?). No one complains about their Executive salaries, the amount they collected from Wall Street for what so many are saying are worthless measures.

CMOs blew up. The still exist, today. CDOs blew up. The will exist tomorrow. The products will change and maybe the investor classes will get more targeted. Did you notice that the latest Moody's CDO model - at least in the advert I glanced at yesterday, incorporates i-th-to-default modeling? That suggests that people may be getting smarter about the credit risks they agree to sell short.

There will continue to be a market for "everyday risk" asset-classes. As John Templeton once said, "What are you going to do? Sell everything and wait for the world to end?"

What we do not know is whether those who leverage "everyday risk" will ... "endure", for lack of a better phrase. You'd think not, but you might be wrong.

Posted by

Amicus

at

8:19 AM

0

comments

![]()

Labels: Nassum Taleb, Risk Management, VAR

Sunday, December 7, 2008

This Week In Markets History

Didn't want to miss this one, since we get a new record (or two!) almost every week now:

Dec 3rd, FT

The Markit iTraxx Crossover index rose above 1,000 basis points for the first time since it was created in 2004, ...The index, composed of 50 mostly junk-rated companies in Europe, rose 60 basis points to highs of about 1,020bp, according to Markit, the data provider.

It was trading at about 700bp, or a cost of €700,000 to insure €10m of debt annually against default over five years, on November 1. Before the credit crunch it was below 200bp.

Also, Gold prices on Comex were in rare - very rare - backwardation on the 2nd and 3rd. [I'm looking for a chart/data...]

Posted by

Amicus

at

1:26 PM

0

comments

![]()

Labels: 2008 Financial Crisis, Markets History

Invincible Wall Street

PUBLISH OR PERISH?

Remember Arther Andersen, the great accounting firm, built up by years of hard work in a competitive environment? Member of the "Big Seven" and then the "Big Five"?

Well, once they lost public trust, Andersen was brutally punished, as their clients had to leave them.

So why are the ratings agencies, Moody's, S&P, and Fitch all ... doing business as usual?

Sure, the Justice department got involved because AA's Dallas office was exceptionally naughty (in comparison to other auditing fiascoes), but is the business of public accounting - are the goals of public accounting - really that much different than rating agencies?

At least with GAAP, there is a FASB and a public agency, like the SEC, who are subject to public pressure and provide a visible process.

Well, Bloomberg filed a FOIA request on the Fed, but what about the ratings agencies? At a minimum, they should publish their CDO model, their current and historical model assumptions, and their estimation methodology/data to the public, right?

Posted by

Amicus

at

12:30 PM

0

comments

![]()

Labels: Invincible Wall Street

Friday, December 5, 2008

Trump is no Carnegie

Of course, the Empire State Building was built during the onset of the Great Depression.

But, that's not good enough for Donald Trump.

He wants his money back, more or less. [Trump Sees Act of God in Recession]

Floyd Norris chuckles:

I read a fair number of lawsuits in this job, and Mr. Trump’s are among the most colorful. I get the impression that the lawyers do not always control the drafting.

Posted by

Amicus

at

11:03 AM

0

comments

![]()

Flat with Beer Chaser

Despite stepped up prevention, foreclosure starts were flat on the latest MBA dipstick:

“In the last quarter we saw about 575,000 foreclosure actions started, compared with an estimated 580,000 in the second quarter and 535,000 in the first quarter. At this rate we are looking at finishing 2008 at about 2.2 million foreclosure actions started. Absent a recession, the 2009 number would likely have fallen by several hundred thousand but the effects of job losses and general economic deterioration make the 2009 outlook worse, particularly if mortgage problems [?] become more widespread,” Brinkmann said.

This means that Ben's guesstimate for 2.25 million, from just yesterday, is kinda the best case scenario, other things being equal.

The figures may have been influenced upwards by the end of state moratoriums on foreclosures (why the data cannot be adjusted for this, only the MBA knows...). How many more mortgage foreclosures from California and Florida are possible (they are about half of the foreclosure total)? Good grief.

Meanwhile, serious delinquencies are at previously unrecorded levels... Prime is up at 2.87%. At 0.52/quarter, that's an acceleration given a y/o/r rate of up 1.56. Somehow these delinquencies are being cured, because the foreclosure start rate for prime is flat and those already in foreclosure is up a lot less (0.16 t 1.58), on the MBA survey data, at least.

Posted by

Amicus

at

10:22 AM

0

comments

![]()

-533, THIS is how a recession feels

The media headline comparisons to "the worst on record" are not standardized.

As a percentage decline in the workforce, it is about 0.4%. That puts it on par with the 81-82 drop and twice the size of the 91-92 falloff.

It's well below the 74-75 worst experience.

On the longer record, there are monthly drops that are double ...

Update of interest: There are many years in which there were no monthly falls in payroll employment. However, this is the first year that there will likely be no monthly increase in payroll employment. This is a long series. That's pretty stunning. In 1982 there were two up months and in 2001, just one. They were small, but still up (seasonally adjusted).

Posted by

Amicus

at

8:50 AM

0

comments

![]()

Holy Super-Contango, Batman

The Super Contango is now a Giant Super Contango.

Prices here.

(I don't want to be around when this rubber band snaps.)

Posted by

Amicus

at

7:41 AM

0

comments

![]()

Labels: 2008 Financial Crisis, Markets History

GM Dealers' Pinch

Turns out that working capital loans, i.e. floorplan financing, is pinched.

You know this if you listen to Donnie D (more like hear it in the background than l-i-s-t-e-n), but Wagoner confirmed it yesterday. Said that the crunch-related adjustment will hit manufacturer production in January, most likely (maybe down over a stunning 50%).

Posted by

Amicus

at

7:35 AM

0

comments

![]()

Last Chance to Save BOA, Today

Shareholders will vote the (overpriced) deal for Merrill. They should ... just say "no".

Justin Fox explains:

The reason we are not in investment banking business in a large way is that it's culturally incompatible with the traditional banking business.

Felix Salmon piles on:

Investment banks have a natural tendency to expand until they use all of the balance sheet they're given. ... they're constitutionally incapable of constraining themselves. And when they merge with -- even when they're taken over by -- commercial banks, they invariably end up taking over the host organism and seeding their high-tech products all over its balance sheet.

CEO Lewis? Well, he's on the Sports Illustrated cover, and you know what that means:

"It is incumbent on all of us to help our industry find a new balance between the desire for economic growth and the need for market stability," Lewis said at a dinner in New York after receiving American Banker's Banker of the Year Award.

BOA shareholders will rue the day. $5 Billion in write-downs expected in their opening quarter together, and the Merrill Board also approved an unchanged dividend. Red is the color for this wedding, in every sense of the word.

$875 Billion in deposits at risk. Taxpayer guarantees now going to support ...

Posted by

Amicus

at

6:20 AM

0

comments

![]()

Labels: BOA, Glass-Stegall

Thursday, December 4, 2008

Federal Reserve Talk Among Themselves

A scan through Ben's speech today leaves one ... underwhelmed.

More than a year after the prognostications of rate-resets and the prospect for widespread defaults/foreclosures, and the Fed has its first conference that ... touches on preventable foreclosure.

More than two years after housing prices peaked, the implications for the real economy from foreclosure ... er, get high-level attention?

And you know just how bad it is, when you dig into the references and you find out that the Federal Government, in 2008, is licensing the data it desperately needs in order to do policy formation and that data is ... incomplete:

We use data licensed from LoanPerformance as the basis for our analysis. We define a subprime loan as a loan in a subprime pool and likewise an Alt-A loan as a loan in an Alt-A pool. Thus, these data will not include risky mortgages that lenders keep rather than securitize; about 75 percent of subprime originations were securitized in recent years ...To measure is to manage.

Posted by

Amicus

at

12:31 PM

0

comments

![]()

After Ten Years of "Innovation", What More Do We Know About How to Price (or Trade) Credit Risk?

INABILITY TO ISOLATE "THE PROBLEMS" LEADS TO RADICAL DOUBT

If you want a qausi-seminal piece that will challenge you in every direction, have a look, maybe, at the Sam Jones bit in the Alpahville about Synthetic CDOs and, by incorporation, the pieces by Felix Salmon and Alan Kohler.

It doesn't aspire to be "seminal", but it juxtaposes market structure with technological understanding, for example,

For the monolines and insurers, this wouldn’t have been such a dreadful problem had they not also invested in the underlying notes of many CDO structures: a move that led to the rating agencies downgrading them, and thus exposing them to collateral calls on their billions of leveraged super-senior swaps.

and an explanation how a perceived need drove design, alongside an historical bit of what went wrong when those designs proved insufficient:

Citi’s dalliance with LSS conduits and the commercial paper markets was equally catastrophic. In the summer of 2007, it caused the collapse of several large conduits in Canada. That in turn precipitated a global buyers strike in asset-backed CP. Which spread, in turn, to a buyers strike of all financial CP. Thus ratcheting up the threat of banking collapses, and indeed, leading directly to them, in Germany, and in the UK (Northern Rock).This goes well beyond the ongoing talky-talk about originate-to-distribute market structure.

If you are very late to the game of understanding today's structured products (like me), their role in the crisis, and trying to separate dysfunction from abuse, you probably could count yourself close to it if you grasped this piece, in detail, not just gravamen.

And that understanding is not easy to come by, not the least of which is that there are so many moving parts to these structures and little commentary on how they were used and by whom in what proportions. So, for instance, if you wanted to make a judgment about whether and how these securities should be regulated, you'll just be left asking for more data, most likely.

HIDING RISK AS A PRECURSOR TO TRANSFERRING IT

Economists are quick to laud the benefits of financial innovation. Perhaps they should consider the "start-up" costs of it, the context in which it occurs.

If "innovation" in the medical sciences is marked by a caution sufficient to protecting the credibility of the science itself, then the hallmark of financial innovation seems to be the reverse, on average - at least when it is applied to "investments".

Case in point: read through the prospectus for a synthetic CDO contraption (kindly provided by one of Felix's readers). Do you think you could make an adequate assessment of the risk-characteristics of any one of the notes (tranches) to be sold? Would you "invest" a billion dollars based on 'Moody's model input #2', even if you had no fear of models and modelling in general? Is it any wonder that Steve Eisman is a rich man today, for having noticed this?

JUNK BOND (SUBPRIME) MANIA

Commentators talk about the massive mis-pricing of credit risk, at the heart of the current crisis. But, that cannot be the whole of it.

Why?

Well, ask yourself, how could trillions of dollars be written on sub-prime mortgage risks, either cash or synthetic (!), with such a short history by which to judge their risk characteristics? Wouldn't prudence dictate that you make the most radically conservative assumptions (about joint transition and default probabilities), before betting so much money? I mean that to apply to both seller and buyer, one interested in preserving (and building) their marketplace overtime, the other interested in managing known unkowns, the downside risks.

How much were the risks simply hidden and not just in rational self-deception? Hard to say. Were the assumptions that launched the era certifiably blue-sky? Were people perfectly right to be so wrong? Does financial innovation somehow require a non-simulated crisis or catastrophe, in order to complete its own cycle, to calibrate itself? That's like saying, "until these things are liquidated, no one really knows what the value of them will be." Is that true?

Whatever leads buyers and sellers to kid themselves ex ante, doing so creates what I like to call "opaque potential", which is the spawning ground for almost all financial manias.

That all financial innovation is fertile ground for a financial mania is probably untrue, but being able to spot which ones are is probably not as much of an art as some may think.

Posted by

Amicus

at

7:59 AM

0

comments

![]()

Labels: 2008 Financial Crisis, CDO, CDS, financial innovation, Synthetic CDO

Wednesday, December 3, 2008

Bear Food

PLEASE DON'T FEED THE BEARS

Okay, so, now that refi index has spiked and Bill Gross had said mortgage rates will have a four handle, who owns the CMOs and doesn't know what they are doing?

Posted by

Amicus

at

1:38 PM

0

comments

![]()

Chart of the Day

From Felix Salmon, via PIMCO, a view of Tobin's Q. Notice that if you used the Q in 1996 (the last time I remember talking about it with anyone), you'd have "missed" the great run-up of the late 90s...

Posted by

Amicus

at

1:38 AM

0

comments

![]()

Labels: Chart of the Day

Tuesday, December 2, 2008

Allocation Nightmare

GO LONG!

Among the retail accessible asset classes, this has turned into one of the biggest "kick-me's" of the year, from an asset-allocation perspective:

The so-called long bond has returned 27.8 percent this year, including a 15.6 percent gain in November, Merrill Lynch & Co. index data show. The debt is poised for the best annual performance since rallying 34 percent 13 years ago.

Yields touched 3.1789 percent today, the lowest since the U.S. began regular auctions of the securities in 1977. -Bloomberg

Morningstar reports that the average long government bond fund is half that return.

THE NASTY END OF 'DO YOU HAVE ENOUGH INFLATION PROTECTION?'

Meanwhile, TIPs have hardly been a dreamy asset class. The average inflation protect bond fund is off some 7.8%, with large funds like PIMCO's off another 4.5% beyond that... That's a lot of jazz for an asset class with an historical annual volatility between 1% and 2%. (One fund company has inflation protected funds off over 20% YTD!)

CANNERY ROW ALLOCATIONS

Last, it is noteworthy that the average, canned "Conservative Allocation Fund" is off over 23% YTD.

Personally, I cannot believe ever letting that happen to a client. You can bet that dynamic/tactical allocators, like me, won't be back in demand soon, however.... (if I'm wrong, let me know!).

Posted by

Amicus

at

6:14 PM

0

comments

![]()

Monday, December 1, 2008

Meridith - Still Good For A Big Bear Day

EASY MONEY - 9% DOWN IN EQUITIES TODAY

In the face of expanded holiday shopping over Black Friday, rising real disposable income, and massive oil price decline, upcoming stimulus (probably including 'retail' tax cuts), today we suddenly realize that banks may pull credit lines?

Clearly, the bears are just out today to grab any "rally food" they can, right? I mean, apart from China's turnabout and Hank "Menace to the Markets" Paulson coming out to say that he was, after another week, still studying the problem of preventable foreclosures.

If anything, the message is clear that the banks cannot try to write the best vintage "loans" during the immediate crisis, without risking the very downturn that they would hope to forestall, collectively, right?

Average margins in the credit card business are on the rise. There is $200 billion in cheap financing from the Federal Reserve available. At 2/3rds of an entire year's volume, that's a fair amount of flash-money at the margin, even if it is unnecessarily restricted to 'AAA' credit only, IMHO.

Willingness to lend is a serious concern that needs to be addressed.

Potentially a more serious, long-term adjustment is the large number of people who may get shut out of the consumer credit markets, because our current Treasury Secretary and his boss have decided that the best way to handle the housing market bubble is to "let foreclosures work". For the average lender balance-sheet, I'd bet that the average REO is an order of magnitude larger than the average credit card balance.

Posted by

Amicus

at

3:59 PM

0

comments

![]()

Innovation or Exploitation?

HOLDING JUDGMENT UNTIL THE DATA COME IN

I wonder if this article by Austan Goolsbee was written before or after we found out that maybe 50% of all sub-prime loans went to people who could have qualified for prime?

What more have we found out about those lenders who 'targeted' the elderly, sucking the equity out of their home, with loans that "required" refi's every x years (and subjected people to pre-payment penalties)?

There is more ...

I'm trying, as best as possible, to withhold judgment until the data is in.

Sadly, I doubt it is coming.

Innovation is grand. "Suckering people" is never laudatory, even in the name of innovation.

Any brokered, relatively illiquid market is a prime candidate for abuse, true or false?

Posted by

Amicus

at

12:11 PM

0

comments

![]()

The Case of the Omniscient Regulator

Exception noted:

I see little hope of creating any kind of "early warning" system, if by that Mike means better forecasting. Crises like the current one are inherently unpredictable. If they were predictable, hedge funds and other money managers would not lose so much money during them.

-Greg Mankiw

"Inherently"? I don't think so, completely, even if it means "forecasting", to a degree.

The tools to manage risk are all in plain sight. All that one needed to do, perhaps, is to have looked at the growth charts, for CDS and for RMBS issuance in the asset-backed markets. When you view exponential growth, you worry aloud, quickly and actively.

A glance at a chart does not involve some complex understanding that goes beyond the comprehension of savvy market participants. What's more, those participants weigh a different set of concerns, most commonly, see a different utility in the outcomes. (Put another way, Greenspan was arguably wrong to have let himself get swatted with this argument, by Wall Street, when he caused them some pain by issuing the stupendous phrase that defined an era, "irrational exuberance".)

Indeed, if the 'shocked disbelief' of the current period has instructed anything, it is that an unencumbered embrace of self-regulating, all-seeing "markets" is gravely misplaced. Even on practical grounds, it may have been far less costly to the general welfare to have tried and failed than to have done nothing at all.

It helps to be particular, as well.

The key problems of "systemic risk" to the financial system, which one could argue center on AIG and Lehman, so far, both involved many risks that were certainly knowable a priori. I don't' think there was much "inevitable" about their failures.

The key problems of "economic risk", like the loading on of debt, the decline in national savings and a structural trade deficit, are problems that can be dealt with "systematically", by policy choices.

HAVING THE SAME DEBATE, OVER AND OVER AGAIN, DESPITE THE EVIDENCE

In another context, Greg argued:

But I continue to believe that there are other choices.Following that thought, perhaps it is past time to get past old dichotomies and argue, instead, how best to formulate a set of better regulators and regulations.

Posted by

Amicus

at

10:50 AM

0

comments

![]()

Sunday, November 30, 2008

Nouriel has a Black Friday

Uh, oh:

CNNMoney reports:

"Under these circumstances, to start off the season in this fashion is truly amazing and is a testament to the resiliency of the American consumer, and undeniably proves a willingness to spend," Martin said in a statement.

Posted by

Amicus

at

10:07 AM

0

comments

![]()

Wednesday, November 26, 2008

The Bears Have Come Home

"Where are we in the cycle?"

"Goldilocks has eaten and slept and the bears have just come home."

Meanwhile, real disposable income was up on this morning's dipstick, so ...

Posted by

Amicus

at

9:05 AM

0

comments

![]()

Tuesday, November 25, 2008

No Federal Money for Lender Education ...

NO SUCH THING AS A STUPID LOAN OR A SILLY LENDER

If you missed it, they are all excited over at HUD about a new form, that has no enforcement mechanism and won't be required until 2010. (It's still a big deal, maybe a break in a multi-decade log-jam, even).

Meanwhile, everyone, Left and Right, is agreed that some form of debt-counseling helps improve mortgage loan performance. We voted federal money for it, in the past year, maybe twice.

Still, no one appears to study the affect of education (or jail?) on ... those doing the lending. It's an abstract we prefer to call 'structural market failure', I guess, related to 'mis-aligned' incentives. No culpability there.

The knee-jerk free-marketeers seem to believe that the appropriate penalty for lender silliness is their own bankruptcy, not discharge of their poorly conceived loans.

Posted by

Amicus

at

12:22 PM

0

comments

![]()

Financial Statement Variety

Sampler from some of the recent financial reports for financial institutions. Sometimes, things just jump off the page at you:

Sampler from some of the recent financial reports for financial institutions. Sometimes, things just jump off the page at you:

(1) The Sub-Prime Group (SPG) exposures became fully integrated into VAR during the first quarter of 2008. As a result, September 30, 2008 and third quarter 2008 average VAR increased by approximately $60 million and $73 million, respectively. June 30, 2008 and second quarter 2008 VAR increased by approximately $95 million and $135 million, respectively.

(1) The FRB granted interim capital relief for the impact of adopting SFAS 158, “Employer’s Accounting for Defined Benefit Pensions and Other Postretirement Benefits” (SFAS 158), at December 31, 2006.

The claims are for breaches of the duty of care, breach of fiduciary duty, waste, insider trading, fraud, gross mismanagement, violations of the Sarbanes-Oxley Act of 2002, and unjust enrichment.

Derivative contracts with a financing element, net | YTD 2008 73 | YTD 2007 3,887 |

Posted by

Amicus

at

11:49 AM

0

comments

![]()

TALF

This new ABS lending program from the Treasury/Fed is quite a powerful construct, providing 'levered financing' to the market. Woo-hoo!

This term-financing for up to a year for a variety of initial asset types, subject to a (one-year?) price-volatility haircut. The collateral must be "AAA", highest quality. In addition to the price/market-risk haircut, the Treasury then backstops the Fed with an equity pool, for the credit risk.

Two things I don't like, based on a quick first-read.

- 'AAA' may not be the part of the market that needs the most help. I'd like to see a broader range of collateral. All qualities may need help, to the extent the market is shut down, but still.

- The Treasury ought not to be the one managing the collateral, unless it intends to immediately enter into a forward purchase agreement with someone in the marketplace (and take a residual risk to lubricate the deal, maybe).

The Fed using it's balance sheet during crisis is just fine. However, with this latest construct, the Government looks like it is too much both the supply and the demand for funds. Of course, it's just $200 billion, so no need to wring hands over it, either.

"Dual-action" may be fine to address a blip in a market or smooth things over, in a market that isn't huge. It may even be a powerful "can-do" in a near deflationary environment.

But, on face, it doesn't seem a sound recipe for the long-term or for much larger asset classes, like commercial real-estate or private-label RMBS (nor does 1-yr term financing, given the duration of the underlying collateral of those instruments)

Posted by

Amicus

at

10:22 AM

0

comments

![]()

Labels: 2008 Financial Crisis, Fed, TALF

Fannie/Freddie Bashing To Continue

...until agency spreads blow out, no doubt. Just another lame attempt by the outgoing administration to hand-tie the nation and the new administration.

There are days that I think the GOP no longer care about the finances of the Republic - even its homeowners - and would just assume see it go through "bankruptcy", just like they want for GM and every other homeowner who gets a foreclosure notice.

It bears reminding, I guess, that we are a nation of people, not merely cash flows and assets:

So, now that the McCain camp which tried to use this same “Fannie/Freddie did it” fairy tale in its anti-Obama campaign—is history, as is most of Fannie and Freddie--what are the Republicans going to dredge up to in an effort to sanitize their regulatory shortcomings and, once again, blame Fannie Mae and Freddie Mac?

Most observers point to the seminal actions by Mudd and Syron, respectively, to purchase large amounts of toxic Alt A and private label subprime securities (PLS) in 2006 and 2007, as the major red ink causes.

But, almost as important, is the fact that virtually every aspect of the two mortgage companies business was presided over and blessed by their former regulator the Office of Housing Enterprise Oversight (OFHEO), following the May, 2006 consent agreements both companies signed with OFHEO. From that point on, the regulatory agency had their own employees in both companies every business day of the week reviewing all transactions and decisions.

If the former GSE managements made bad business calls, what’s that say about the OFHEO staff who shared in their meetings and machinations?

This next Waxman hearing should be fun to watch as the Committee GOP has to perforce blame other Republicans for mortgage misfeasance or malfeasance!

Posted by

Amicus

at

8:12 AM

0

comments

![]()

Monday, November 24, 2008

Read Your Mankiw

THE PRICE OF INFLATION/DISINFLATION/DEFLATION UNCERTAINTY

Robert Barro points out that there may be a current, sizable deflation risk premium, just as there was once an inflation-risk premium incorporated in the observed yields (although some thought that had since passed, with the ability to use products to manage inflation risks...).

Uncertainty about how best to use these expectational variables has kept me from updating the rates chart, for now. They are projecting maybe five years of deflation. [!]. It's possible that the structure of the TIPS offering has some technical impact, not just the liquidity.

Separately, perhaps one of the NIPA pros can explain why the price indexes for Q3 GDP were rising for line items like "Gasoline, fuel oil, and other energy goods" and how the consumption deflator seems... so large.

Posted by

Amicus

at

11:40 PM

0

comments

![]()

Citi By The Numbers ...

TARP INFUSIONS ONLY INDIRECTLY RAISE COMMON STOCK PRICES

There is this post over at Brad DeLongs, with a high level view of what happened to Citi.

Here is another stylized view, Citi by the numbers:

At the end of 2006, Citibank had just under $90 billion in tangible, common shareholder equity. That would be about $18/share. The market liked Citi enough to pay up almost 2.7 times tangible book for a common share.

Twenty-one months later, by the end of the third quarter of 2008, Citibank had recognized $32.2 billion in credit losses and provisions for losses, earning 3.6 billion in 2007 and losing about $10 billion in 2008 (so far).

Tangible book value of common was $68.8 billion or about $12.60/shr and the market was paying up as little as $4-$6/shr, implying significant further loses. If those loses were in the range of $33 billion, it would imply a valuation of just 1.0 times tangible book (based on my guesstimates for earnings over the next 18 months).

Yes, that's a big drop in the premium paid. The stock is "washing out", as the pros say.

n.b. TARP "infusions" do not make the stock price go up or boost the capital stake for common holders, just for the firm as a whole. I'm guessing this may be creating a great deal of confusion in the punditocracy, because it looks like the TARP isn't "doing anything", because people are looking at the common stock price and asking, "why is it going down, not up, after TARP?"

See also, The Bankless Rally

WHAT'S THE BREAKDOWN FOR HOW CITI 'LOST' ITS MONEY SO FAR?

I don't have these figures in detail. The company did offer up this high-level summary, during it's "Townhall Meeting". "LLR" are loan-loss reserves. "S&B" is 'Securities and Banking', which, for them, includes structured products, trading, private equity, investment banking, hedge funds, and a lot more.

Posted by

Amicus

at

10:47 PM

0

comments

![]()

In Finance There Is No East or West

FIND YOUR INNER VULTURE - THE TIME IS RIPE

The service companies arise:

Colliers Abood Wood-Fay Launches Distressed Property Services Group

Published: November 20, 2008

Miami--Colliers Abood Wood-Fay recently launched its Distressed Property Services Group. The group brings together an integrated team of resources, disciplines and professionals with over 75 years combined experience in managing distressed assets in inflationary or recessionary markets.

I mean, people are asking, "How do I get a piece of TARP?" Well, now you know...

Posted by

Amicus

at

1:29 PM

0

comments

![]()

Is CNBC hopeless?

They are focused on some stupid meme about taxes on the wealthy?

We're bailing out the entire financial system, and this is what is topic number one?

The market is selling off? As if they have never heard about sell the news? (*eyes roll*)

Posted by

Amicus

at

12:52 PM

0

comments

![]()

Obama - First Press Conference

Very impressive.

- -Clean grasp of the multi-faceted problem (even talked about doing more than one thing at a time).

- -Handled long-term and short-term aspects of economic stimulus with alacrity

- -Daily briefings - perhaps indicates a markets orientation right at the top

- -"In charge" - no wandering or pushing off to advisers on basic structure, goals or intent of policy

- -Stimulus will be almost first act as President and will include changes to various processes of government

- -Bailouts for Detroit will be as "sound" as practicable

In fact, the only detraction perhaps was the characterization that Americans have pride in their auto industry. I think we are finding out, from the polls, that is about 50/50.

Christina Romer is an impressive grab. Can you imagine an afternoon with Summers, Romer, and, say, Doris Kearns Goodwin in the Oval office? It seems like we can sleep a little easier than during the Bush Administration, at a minimum.

Posted by

Amicus

at

12:33 PM

0

comments

![]()

Bailout Sundays

SAVING PRIVATE RYAN, ...ER, CITIBANK

Our Nation's quick-draw team has ... had another bailout weekend. Citigroup is the patient on the table, five-days after they started a free-fall. The deal is the deal, improvised or not. I don't think you need to take-up 90% of the residual to make a good re-insurance market, but other (more informed) opinions could be had on that. It's a noteworthy point, especially because one may want to repeat this guarantee immediately at the next target (and there will be one, right?). I also think that the government should have left some of the tail probability on the table, taking just a "slice" not the whole enchilada. Last, a back-of-the-envelop, 10% haircut seems ... so yesterday, compared to the valuation technologies available, presently. Also, I guess Wilbur Ross, a lighthouse of the free-marketeers, wasn't available...

The deal is the deal, improvised or not. I don't think you need to take-up 90% of the residual to make a good re-insurance market, but other (more informed) opinions could be had on that. It's a noteworthy point, especially because one may want to repeat this guarantee immediately at the next target (and there will be one, right?). I also think that the government should have left some of the tail probability on the table, taking just a "slice" not the whole enchilada. Last, a back-of-the-envelop, 10% haircut seems ... so yesterday, compared to the valuation technologies available, presently. Also, I guess Wilbur Ross, a lighthouse of the free-marketeers, wasn't available...

The markets will likely cheer the result, in a modest way, but will wonder if we still have moved from weekend-solutions to a comprehensive solution that was sought by "enacting TARP".

MEANWHILE, IN THE REAL ECONOMY

Meanwhile, the worst number from last week was the yield on long-term Treasuries.

That was no panic buying (I don't think). The market has clearly started to lose confidence in the direction of the real U.S. economy. Chief culprits are the Bush-Paulson abdicating their leadership and a lack of a plan to address the bad-asset problem, right at the source - foreclosures, real-estate price declines, and, now, weak economic activity.

WHEN ALL THE SHOES HAVE DROPPED ...

The diagrams of a "bad-asset cycle" suggest, conventionally, that economic stimulus will "break the cycle", even if I thought that addressing the bad-asset problem (the value of home collateral) directly would have been a good first "stimulus" step.

So far, our reactive policy seems unable to get ahead of the curve. We haven't stopped any market from "breaking", that I can think of. To paraphrase Galbraith, "the key feature of the panic was that it kept getting under-estimated [until the system was so weak that antibiotics wouldn't work]."

Snarking aside, we can (and must) track the shoes in the cycle:

On deck:

Posted by

Amicus

at

8:35 AM

0

comments

![]()

Sunday, November 23, 2008

Cycling on Empty

For those who keep asking about a market bottom, Paul Kedrosky wonders aloud about whether the worst is past.

The lack of systematic, government-mandated and collected statistics on the structure of the mortgage loan market appears to be a running theme in how the uncertainty keeps going, and going, and going. (There may be some that I just do not know about).

Among the things I haven't seen systematically outlined:

- How many sub-primes have been re-financed into primes, and who were the companies that originated those loans

- How many loans, of all types, have pre-payment penalties, and who were the companies that originated those loans

- How many ARMs, by class/type, are pay-option arms, and who were the companies that originated those loans

- How many loans had mortgage insurance paid for by financing and who were the companies that originated those loans

- How many IO's have terms greater than 30 years, and who were the companies that originated those loans

- For a variety of cross-sections, what are the summary statistics for the "margin" required? How many have a margin so high, on re-set or otherwise, that the "normal economics" of the loan are "gotcha", i.e. as time passes, the chances are great that indebtedness (total due) will increase, perhaps even if rates fall?

For those reading comments to PK's post, without knowing the array of mortgage market products (I certainly do not), here are some jargon qualifiers:

5/1 ARM, 7/1 ARM, 10/1 ARM - these refer to mortgages that are fixed at an initial rate, for a period of 5, 7, or 10 years, and then reset every year after that. These are sometimes called "hybrid arms". They are to be compared with ARMs that do not have the initial fixed rate, but just re-set periodically from the outset. [I believe, but i'm not certain at all, that there were also ARM mortgages, at one time, in which there was a low initial rate, either floating or fixed, and then you moved into a fixed rate for the remainder of the term.]

ARM 5/2/5 - refers to the limits on how the interest payment reset is done. "First, subsequent, life" is the memory aid: how much the first re-set is limited to, how much each subsequent re-set is limited to, and how much all cumulative re-sets (up or down) are limited to.

IO - loans can be "fully amortizing" or "interest only" (IO)

CMT - is constant maturity treasury (most popular is 1- year maturity for ARMs).

MTA - is not anything related to a transit authority. It is "monthly treasury average" rate. It's just a month average of the CMT values, not a new maturity/duration. As an average, it smooths out the month-to-month volatility.

The last/current 1-yr MTA is 2.256% (although most mortgage contracts round to the nearest 1/8th or something at re-set).

The current 1-yr CMT is 0.96% [!!!].

On the other hand, the 1-yr ARMs rates for new mortgages are surveyed at over 5% and 5/1 ARMs higher still. It looks like 1-yrs bottomed out at 4% when Greenspan took policy rates as low as they are today.

Posted by

Amicus

at

11:00 AM

0

comments

![]()

Friday, November 21, 2008

Chart of the Day

So, Tim, how are you at insurance? (Do we dare to ask Paulson & Co.?)

I mean, you can "TARP" Citi if you need to, but, in the words of MetLife, "Who's gonna pay for this mess?" (and it *must* be attended to, maybe even this weekend):

The Hartford Group and Lincoln Life, 5-days of gruesome giddy-up

Chart of yester-jour was AMBAC, up 86%:

Ambac Assurance Corp, Ambac's main unit, paid $1 billion to get out of four contracts it had written to guarantee collateralized debt obligations, reducing the bond insurer's liabilities. It said the terminations would allow it to reduce reserves set aside for market losses on these guarantees. - Reuters

...but today, the "ratings agencies", where everyday is a new day, slammed 'em:

S&P downgraded the senior debt of Ambac Financial (ABK) to BBB from A. It also cut Ambac Assurance Corp., the bond insurance subsidiary, to A from AA. The outlook is negative.-SmartMoney

Posted by

Amicus

at

5:21 PM

0

comments

![]()

Real Rates and Future Growth

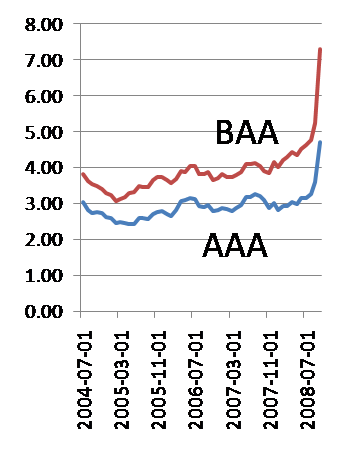

Using the Fed series for corporate rates, less y/y CPI (not necessarily the best, but the easiest), I have a somewhat different picture than PK has for real rates.

In fact, it is sufficiently different that one can question the read that these levels are due to a factoring in of a collapse of the system. Rather, they look a lot more like the "Greenspan conundrum" has been canceled, and the US is ...er, back to where it used to be, in terms of having to price up for capital? On the other hand, the spread has never been wider, from BAA to AAA, which suggests a high degree of risk aversion and that the rates we are seeing are a consistent with a view of who will survive a collapse or a gross estimate / mis-estimate of what the price of credit should look like in advance of the sharpest downturn, possibly, since the data series was collected.

Chart1. Estimated real rates thru 11/19/08., US Corporate Sector (spread shown on RHS axis) THIS YEAR

THIS YEAR

Here is a look at what has happened this year, so one can judge the timing of the rate rise and how much might be attributable to changes in measured inflation not reflected in a fall in nominal rates... (n.b. measured inflation, not inflation expectations, as PK calculated)

Chart 2. Corporate real rates in 2008, with CPI. Spread of BAA to AAA graphed on right axis. I'll update with the expectational variables, if I have the time...

I'll update with the expectational variables, if I have the time...

Posted by

Amicus

at

11:37 AM

0

comments

![]()

Citibank Redux - A Speculative Attack?

Is Citigroup under "speculative attack"?

"Discuss amongst yourselves."

There is a fairly strong prima facie case.